Imagine a world where you could do this...

A large nationwide bank enlisted our help to meet a unique challenge (and, oh, how we love a good challenge). The bank wanted to send out welcome letters to each of its new customers. Sound simple? Wait until you see what else the bank wanted us to do before we mailed each letter.

The challenge

The challenge

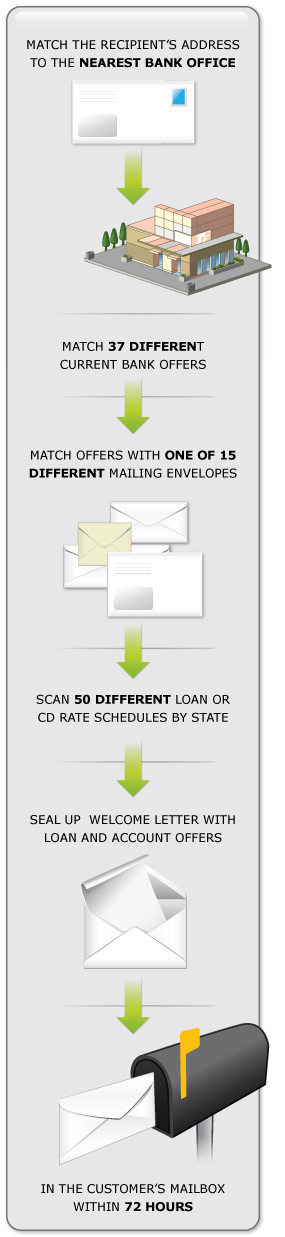

We needed to personalize each letter by matching the recipient's address to the nearest bank office. Then we needed to take 37 different current bank offers and match the right offers to the recipient's needs, depending on the account type, balance and demographics. Then we needed to match the right offers with one of 15 different mailing envelopes, scan 50 different loan or CD rate schedules by state, select the right rates in effect that week for the right loans and accounts, seal up the perfect welcome letter with loan/account offers in the correct envelope and have the bank's greeting in the customer's mailbox within 72 hours. Is your head spinning yet?

The solution

The solution

Our programming team skillfully dissected the challenge. We created a workflow solution that took the bank's raw transactional data and matched new account types, opening balance information and customer demographic codes back to the array of 37 offers. Depending on the offer, our automated solution selected one of 15 envelopes and strategically added bank branch codes and variable-data offer information, matched the state location with the correct account/loan rate matrix that's updated each week online by the bank, posted live proofs the same day that customer data is received, and appended bar codes to each letter to ensure that the correct letter and envelope files were printed on the correct documents.

The solution

The solution

We achieved 100 percent on-time delivery. The bank reviewed proofs the same day files were uploaded. The entire mailing was machine-verified with automated quality control. Postage was optimized for the lowest possible rates. Mail was tracked by individual piece online so that branch office and call center staff could follow up. The project required minimal input from bank administrators, which allowed them to get to important work. And direct mail processes that once took days were reduced to an hour.